Revolut: Redefining Banking for the Modern Age | work from home

In the fast-paced world of finance, staying ahead of the curve is paramount. With technological advancements constantly reshaping the industry landscape, companies like Revolut have emerged as key players, offering innovative solutions to traditional banking services. As we delve into 2024, let’s explore the job opportunities available at Revolut and how they reflect the evolving nature of the finance sector.

Introduction to Revolut Recruitment

Revolut burst onto the financial scene in 2015, aiming to disrupt the traditional banking sector with its digital-first approach. Founded by Nikolay Storonsky and Vlad Yatsenko, the company quickly gained traction by offering a range of services, including currency exchange, international money transfers, and a multi-currency card. Since then, Revolut has expanded its offerings to include features like cryptocurrency trading, stock trading, and even personal loans Revolut Recruitment.

With a customer base spanning over 15 million users globally, Revolut has solidified its position as a fintech unicorn, valued at over $5 billion. The company’s rapid growth trajectory has not only attracted attention from investors but has also created numerous job opportunities across various domains.

Revolt can take various forms, ranging from peaceful protests and civil disobedience to armed resistance and revolution. It can emerge within a specific community, region, or even on a national scale, driven by a desire to challenge the status quo and demand reform or liberation.

Revolt is deeply intertwined with the human desire for freedom, equality, and justice. It can be sparked by a myriad of factors, including economic inequality, political corruption, social discrimination, or authoritarian rule. Revolts have been pivotal in shaping the course of history, leading to the overthrow of oppressive regimes, the establishment of democratic institutions, and the advancement of human rights.

However, revolts also carry risks and uncertainties. They can result in violence, instability, and the loss of lives. Moreover, not all revolts succeed in achieving their objectives, often facing fierce resistance from those in power or internal divisions among the rebels themselves.

Despite the challenges, revolts continue to be a potent force for change in the modern world. From the Arab Spring to the Black Lives Matter movement, people around the globe continue to mobilize and revolt against injustice, oppression, and tyranny, striving to create a more equitable and just society.

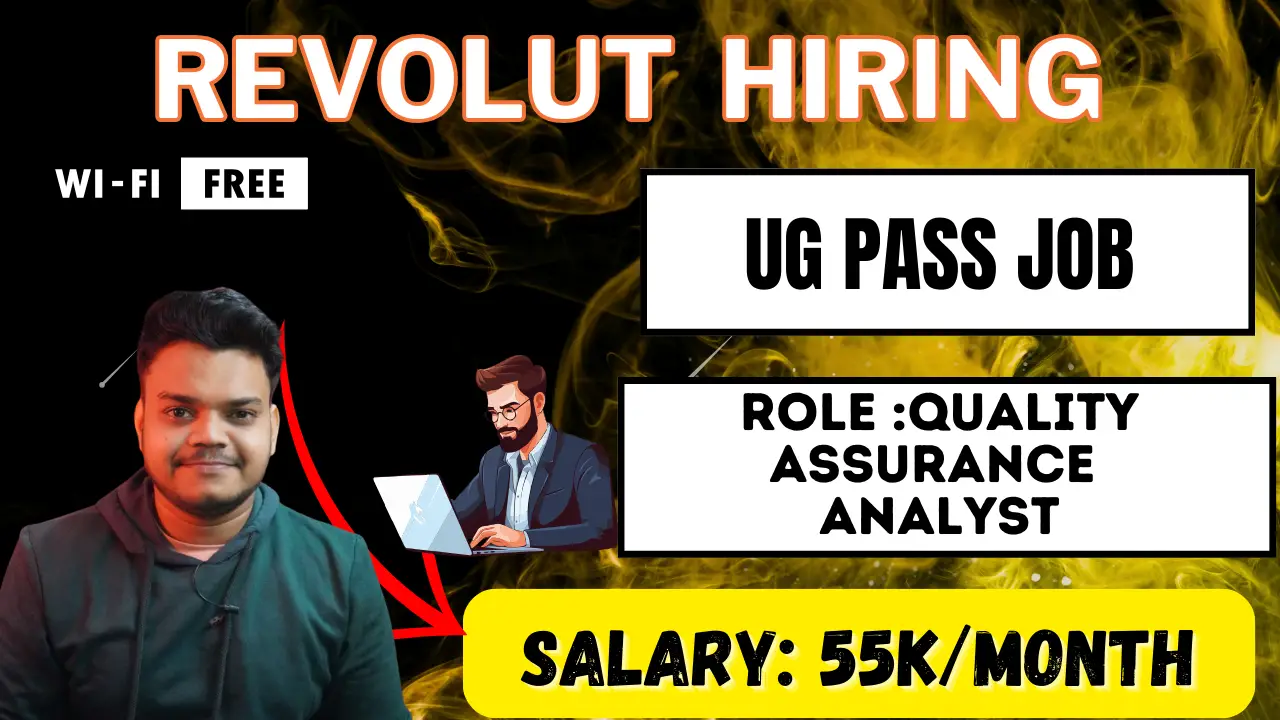

Job Opportunities at Revolut Recruitment

As Revolut continues to innovate and expand its suite of products and services, the demand for talent across different functions has surged. Whether you’re a seasoned professional or a fresh graduate looking to kickstart your career in fintech, Revolut offers a diverse range of job opportunities to suit various skill sets and interests. Let’s explore some of the key areas where Revolut is actively hiring in 2024:

- Software Engineer: Responsible for developing and maintaining software applications, platforms, and systems that power Revolut’s services.

- Data Analyst/Scientist: Analyzing large datasets to derive insights, improve products, and inform business decisions.

- Product Manager: Leading the development and enhancement of Revolut’s financial products and services based on market research and customer feedback.

- Customer Support Specialist: Providing assistance to Revolut’s customers via various channels, including email, chat, and phone, to ensure a positive user experience.

- Compliance Officer: Ensuring that Revolut operates in compliance with relevant regulations and policies, including anti-money laundering (AML) and know your customer (KYC) procedures.

- Marketing Specialist: Creating and implementing marketing campaigns to attract new customers and promote Revolut’s brand and offerings.

- Finance Analyst: Managing financial data, conducting analyses, and preparing reports to support strategic decision-making within the company.

- Business Development Manager: Identifying and pursuing partnership opportunities to expand Revolut’s reach and enhance its service offerings.

Engineering and Technology at Revolut Recruitment

At the heart of Revolut’s success lies its robust technology infrastructure. The company relies heavily on cutting-edge software solutions to power its platform and deliver seamless user experiences. Therefore, roles within engineering and technology form a significant portion of Revolut’s workforce.

From software engineers and data scientists to cybersecurity experts and UI/UX designers, Revolut is constantly on the lookout for top talent to join its tech teams. Whether you specialize in mobile app development, backend systems, or AI-driven analytics, there’s ample opportunity to contribute to Revolut’s technological advancement.

- App Development: The core of Revolut’s services is its mobile app. Engineers work on developing and maintaining the app across different platforms (iOS, Android) to ensure seamless user experience and access to financial services.

- Backend Systems: Behind the scenes, Revolut relies on complex backend systems to handle transactions, user data, security protocols, and more. Engineers are responsible for designing, building, and maintaining these systems to ensure reliability and security.

- Data Analytics and Machine Learning: Revolut leverages data analytics and machine learning algorithms to provide personalized services, detect fraud, and optimize financial processes. Engineers and data scientists work together to develop and deploy these algorithms.

- Security: Given the sensitive nature of financial data, security is paramount for Revolut. Engineers work on implementing robust security measures, including encryption, authentication protocols, and intrusion detection systems, to protect user data and transactions.

- Blockchain and Cryptocurrency: Revolut offers cryptocurrency trading and wallet services to its users. Engineers are involved in integrating blockchain technology, developing cryptocurrency wallets, and ensuring the security and reliability of these services.

- Regulatory Compliance: Fintech companies like Revolut operate in a highly regulated environment. Engineers collaborate with legal and compliance teams to ensure that the technology platforms comply with relevant regulations and standards.

- Customer Experience: Technology plays a crucial role in shaping the customer experience at Revolut. Engineers work on features such as in-app chat support, account management tools, and personalized recommendations to enhance user satisfaction.

- Continuous Improvement and Innovation: Like any tech company, Revolut is constantly innovating and improving its services. Engineers are involved in research and development efforts to explore new technologies, improve existing features, and stay ahead of the competition Revolut Recruitment.

Product Management at Revolut Recruitment

In a dynamic industry like fintech, product innovation is key to staying ahead of the competition. Revolut places a strong emphasis on product management roles to drive the ideation, development, and launch of new features and services.

Product managers at Revolut work closely with cross-functional teams, including engineers, designers, and analysts, to conceptualize and execute product roadmaps. They conduct market research, gather user feedback, and prioritize features based on customer needs and business objectives. If you have a knack for product strategy and a passion for delivering impactful solutions, a career in product management at Revolut might be the perfect fit for you Revolut Recruitment.

Product management at Revolut involves overseeing the development and enhancement of Revolut’s financial products and services to meet the needs of its customers. As a product manager at Revolut, you would be responsible for understanding market trends, customer preferences, and competition to define product strategies and roadmaps. This role requires collaborating closely with cross-functional teams including engineering, design, marketing, and operations to prioritize features, execute product launches, and drive user engagement and growth. Additionally, product managers at Revolut should continuously gather feedback from users and iterate on products to ensure they remain competitive and deliver value

Compliance and Risk Management at Revolut Recruitment

With the rapid expansion of its product offerings, Revolut places a high priority on compliance and risk management to ensure regulatory adherence and mitigate potential financial risks. As such, the company is actively recruiting professionals with expertise in compliance, risk assessment, and regulatory affairs Revolut Recruitment.

Roles within compliance and risk management involve monitoring regulatory changes, implementing internal controls, and conducting risk assessments across various business functions. Whether you’re a compliance officer with experience in financial services or a risk analyst skilled in data analysis and modeling, Revolut offers opportunities to make a meaningful impact in safeguarding the company’s operations and reputation Revolut Recruitment.

- Regulatory Compliance: Revolut operates in multiple jurisdictions, each with its own set of financial regulations. Compliance involves ensuring that the company follows these regulations, such as anti-money laundering (AML), know your customer (KYC), and data protection laws. This requires robust systems for customer verification, transaction monitoring, and reporting suspicious activities to regulatory authorities Revolut Recruitment.

- AML and KYC: Revolut must implement stringent AML and KYC procedures to prevent money laundering, terrorism financing, and other illicit activities. This includes verifying the identity of customers, monitoring transactions for unusual patterns, and conducting ongoing due diligence on high-risk accounts.

- Data Protection: With the increasing digitization of financial services, protecting customer data is paramount. Revolut must comply with data protection regulations like the General Data Protection Regulation (GDPR) in Europe, ensuring that customer information is securely stored, processed, and accessed only for legitimate purposes.

- Cybersecurity: As a digital platform handling sensitive financial data, Revolut faces cyber threats such as hacking, phishing, and malware attacks. Implementing robust cybersecurity measures, including encryption, multi-factor authentication, and regular security audits, is essential to safeguarding customer funds and information Revolut Recruitment.

- Risk Management: Revolut operates in a volatile financial landscape, exposed to various risks such as market fluctuations, credit risks, and operational failures. Effective risk management involves identifying, assessing, and mitigating these risks through strategies such as diversification, stress testing, and contingency planning Revolut Recruitment.

- Compliance Culture: Building a strong compliance culture within the organization is crucial. This involves fostering awareness of regulatory requirements among employees, providing comprehensive training on compliance policies and procedures, and establishing mechanisms for reporting potential compliance breaches or ethical concerns Revolut Recruitment.

- Regulatory Engagement: Revolut must actively engage with regulatory authorities to stay abreast of evolving regulations and industry standards. This includes participating in consultations, sharing insights on emerging technologies and business models, and collaborating with regulators to develop effective regulatory frameworks that balance innovation with consumer protection Revolut Recruitment.

- Audit and Oversight: Regular audits and oversight mechanisms are necessary to ensure compliance with internal policies and external regulations. This may involve internal audits conducted by compliance teams as well as external audits by independent third-party firms or regulatory agencies Revolut Recruitment.

Marketing and Growth at Revolut Recruitment

In an increasingly competitive market, effective marketing and growth strategies are essential for acquiring and retaining customers. Revolut invests heavily in marketing initiatives to promote its brand, drive user acquisition, and increase product adoption Revolut Recruitment.

From digital marketing specialists and growth hackers to brand managers and content creators, there’s a wide range of roles available within Revolut’s marketing and growth teams. Whether you excel in crafting compelling campaigns, optimizing conversion funnels, or analyzing customer acquisition metrics, Revolut provides a platform to showcase your talents and drive business growth Revolut Recruitment.

Customer Support and Operations at Revolut Recruitment

As Revolut continues to scale its operations globally, ensuring a seamless customer experience remains paramount. The company relies on dedicated teams of customer support representatives and operations specialists to address user inquiries, resolve issues, and streamline internal processes Revolut Recruitment.

Roles within customer support and operations encompass a variety of functions, including customer service, fraud prevention, and back-office operations. Whether you prefer frontline interactions with users or behind-the-scenes process optimization, Revolut Recruitment offers opportunities to contribute to its customer-centric approach and drive operational excellence Revolut Recruitment.

Faqs

- What is Revolut? Revolut is a financial technology company that offers banking services, including currency exchange, prepaid debit cards, peer-to-peer payments, and budgeting tools, all accessible through its mobile app.

- How does Revolut work? Revolut works primarily through its mobile app, allowing users to open an account, manage their finances, exchange currencies, make payments, and more, all from their smartphone.

- Is Revolut a bank? Revolut is not a traditional bank but operates as a financial institution under a different model. It provides services typically associated with banks, such as currency exchange, debit cards, and accounts, but without a banking license.

- Is Revolut safe? Revolut employs various security measures to protect users’ funds and personal information, including encryption, two-factor authentication, and anti-fraud systems. Additionally, it is regulated by financial authorities in the jurisdictions where it operates.

- What currencies does Revolut support? Revolut supports over 150 currencies, allowing users to exchange and hold funds in multiple currencies within their accounts. This feature is particularly useful for international travelers and those conducting business across borders.

- Are there fees associated with using Revolut? Revolut offers different account types, each with its own fee structure. While some basic services are free, such as account opening and card delivery, certain transactions may incur fees, such as currency exchange or ATM withdrawals exceeding specified limits.

- Can I use Revolut for international transactions? Yes, Revolut is popular for international transactions due to its competitive exchange rates and low fees compared to traditional banks. Users can send money abroad, make purchases in foreign currencies, and even hold multiple currencies in their accounts.

- Does Revolut offer insurance or protection for funds? Revolut provides certain protections for users’ funds, such as safeguarding funds in segregated accounts and offering compensation under certain circumstances. However, it’s essential to review the terms and conditions for specific details on fund protection.

- How do I contact Revolut customer support? Revolut offers customer support through its app, where users can access help articles, chat with support agents, or submit inquiries. Additionally, Revolut provides phone support for premium account holders and other dedicated channels for specific issues.

- Can I use Revolut for business purposes? Yes, Revolut offers business accounts tailored to the needs of entrepreneurs and businesses. These accounts come with features such as multi-currency support, expense management tools, and integration with accounting software.